2022 Second Quarter Newsletter

Helping investors achieve optimal risk adjusted returns on their financial assets using low cost investment vehicles.

Market Trends

JULY 30, 2022

SPY -12.6%, BND -8.2% SPY/GLD 2.5

TWI 60/30/10 ETF PORTFOLIO* -8.1%

Economic engine sputtering? It's stagflation!

I often use a seafaring analogy for my newsletters but this month an automotive one felt more resonant. As I look back to the cause of the massive inflationary spike experienced in June, I can’t help remembering a gas guzzling 1960 era Buick Skylark convertible that a beloved uncle acquired as a big fun summer car. Unlike today’s fuel injected engines, which dole out fuel in precise units, the Skylarks big 400 cubic inch V-8 had a large 4-barrel naturally aspirated carburetor which ladled fuel into the air mixture. It was a muscle car, but the engine had the disheartening characteristics that it would unexpectedly stall or stutter if one stomped on the accelerator too vigorously. The super soaker of a fuel pump would flood the carburetor with too rich of a fuel mixture for the aged ignition system to successfully ignite during the compression cycle. So, from time to time, while merrily driving along the highway with wind in hair, if one felt the need to express the power of the big engine, they would find themselves coasting to a stop. Disheartened, engine stalled, sitting idle roadside, turning the engine over again and again until the air fuel mixture would lean enough for the spark to “catch.” The tail pipe would then kick out a big puff of smoke, the engine would rev to life, and off they would go, a bit wiser to not press down on the accelerator pedal too rapidly.

Something very much like this happened to the U.S. and other world economic zones as the administrative powers, enabled by their central banks, stomped down too hard on their fiscal accelerators to reverse the self-inflicted economic damage that resulted from C19 inspired shutdowns. Choking the metaphoric economic engine with too much fuel (money), they got “stagflation!” The economies sputtered with GDP growth which could not out pace the growth the money. To use an old automotive term, they “flooded it!”

Continuing with my analogy; if the driver realized their mistake quickly enough, lifting their foot off the accelerator, the engine would just stutter and cough, and not stall completely. The trick was then to tap down on the accelerator, just right, so the engine would fire back to life and keep going. Unfortunately, for the uninitiated, the result would often be a head jerking boost of acceleration, then a coasting engine sputter, and then another boost of acceleration and another sputter, as they pressed and lifted their foot trying to find just the right air/fuel mixture. All the while, the passengers and driver head’s nodding back and forth. For the stock market, this translates into an up and down price action. The investment community knows the economic engine is powerful, but it is afraid the guy with his foot on the accelerator (the Federal Reserve and a spendthrift congress) might lift their metaphoric foot too slowly or press down too quickly causing the economy engine to lurch forward then coast, then lurch forward and coast again.

I can only go so far with this economic analogy, but it suggests the real possibility of a double dip or prolonged recession. Will the Federal Reserve drain money (lift the accelerator pedal) faster than the U.S. Treasury can dump money (press down on the accelerator pedal) into the economy? Historically the CBO (Congressional Budget Office) has a poor record of accurately forecasting revenue and spending, on average tending to overestimate future revenue by 7% and underestimate future costs by 3%. This has amounted to an adjusted long-term budget shortfall equivalent to 1.3% of GDP per annum, nearly accounting for all the inflation that can measurably be observed over the last decade. When you hear the administration or congressman blame the war in Russia for 9% inflation you can be highly confident it’s not. Likewise, with inflation in other parts of the world. The U.S. is by a wide margin the worlds largest economy, one of its top energy producers, and arguably its primary central banker. The U.S. exports inflation to the rest of the world!

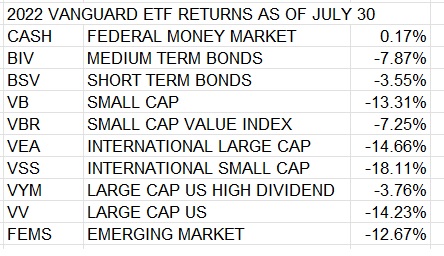

In my last newsletter I estimated where interest rates were headed and at what price to buy the dip in the bond market. Suggesting you buy BSV $76.00/share or better and the BIV at $76.35/share or better. Both dipped in and around those prices the week of July 11th. The July interest rate phenomena is driven by Federal, State and local authorities performing their mid-year fiscal year fund raising. Early to mid-July often presents the best time to shop for bonds during the year. During this period bond dealers will set what they believe is the highwater mark for rates over the next 6 to 12 months to attract buyers into the municipal securities. The bond market will often rally into the fall as dealer supply is worked off. The BIV and BSV are laddered portfolios of mostly U.S. Treasuries securities that are now currently below their face value. As the bonds in these portfolios approach maturity and newer higher coupon bonds replace them the value of these funds and their dividends will naturally move higher. The big question for bond and stock market investors is whether long term interest rates have peaked or if there will be another head jerking swing higher.

The best advice that I can find on inflation uses the price of oil as a fundamental gauge and an indicator of where interest rates are headed. Geopolitical indicators suggest the price of oil will see another head jogging swing higher before it heads lower. That likely means a pause in the current market rally. I still see value in Small Caps like the Vanguard small cap ETF ticker: VB @ <$245 /share or quality large cap dividend value such as the Vanguard high dividend yield index ETF ticket: VYM @ < $120/share.

*The percentages reported are year to date as of market close - July 29, 2022. The TWI 60/30/10 ETF PORTFOLIO is my custom 60 % stock / 30% bond / and 10% cash blend primarily of Vanguard indexed based ETF's. The SPY is the S&P 500 trust ETF. The BND is Vanguards Total Bonds Market ETF.

Invest Wisely!

Douglas A. McClennen(508) 237-2316